Background

October 2023 saw the publication of the UK’s business model for the nascent CCS industry. When I say the business model for CCS, I should clarify that this is the model for CO2 capture, the business model for transport and storage is still under consultation.

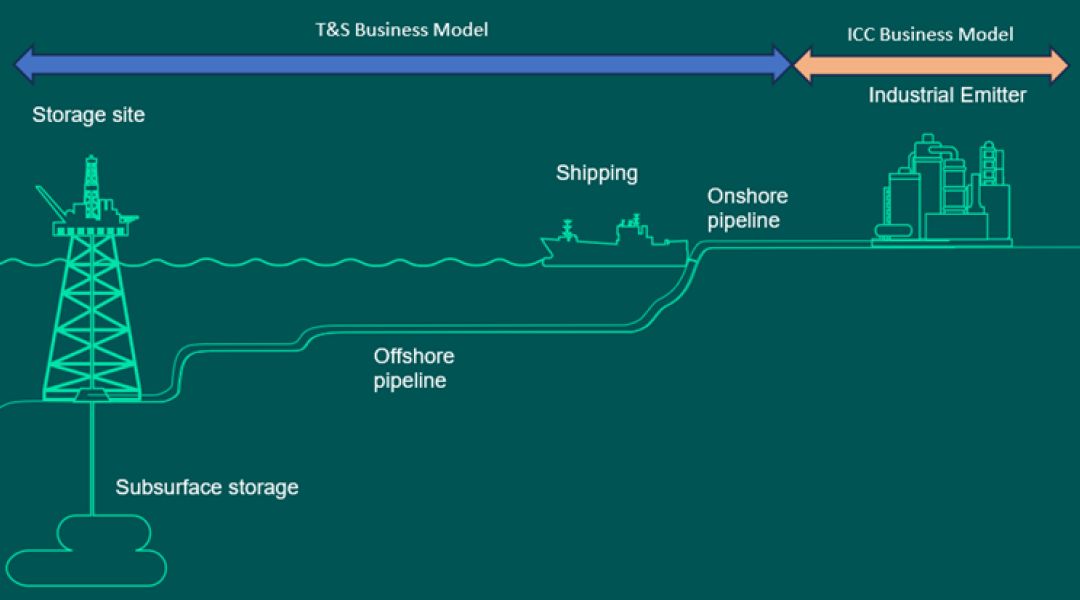

Broadly speaking, the nascent CCS industry in the UK will be covered by two contracting entities that interact with each other - a business model for industrial emitters described as the Industrial Carbon Capture Business Model (ICC) and a second, still to be finalised, for transport and storage.

Figure 1 - UK CCS business model split

The ICC business models have been designed to incentivise the deployment of carbon capture technology by industrial users which often have no viable alternative to achieve deep decarbonisation. Typically, this is known as the hard to abate industries. Back in March, the UK government announced the track-1 / phase 2 projects earmarked for support funding to develop CCS projects within their respective track CCS hubs (NetZero Teesside & HyNet).

East Coast Cluster

- Net Zero Teesside Power

- bpH2Teesside

- Teesside Hydrogen CO2 Capture

HyNet Cluster

- Hanson Padeswood Cement Works Carbon Capture and Storage Project

- Viridor Runcorn Industrial CCS

- Protos Energy Recovery Facility

- Buxton Lime Net Zero

- HyNet Hydrogen Production Plant 1 (HPP1)

The methodology

The ICC business models comprise a capital grant and/or ongoing revenue support which will be funded by the Industrial Decarbonisation and Hydrogen Revenue Support (IDHRS) scheme. The contracts themselves are either generic, ICC contracts, or ones specific for waste management projects (Waste ICC contract).

The UK and Europe have long established cap and trade models for emissions through the respective UK & EU emissions trading schemes (ETS) and it is upon the ETS system that the ICC business model is based. When the ETS schemes were introduced, large scale emitters were given significant “free allocations” of ETS allowances that have been reducing year on year since introduction (cap). The UK ICC business model builds on the use of UK ETS allowances, requiring the surrender of these free allocations. The amount of free allocations to be forfeited is a calculated number based upon the total fee allocation for any given year and the facility capture factor (without going further into protected volumes).

Forfeiture FAs for calendar year = Total Annual FA Allocation for calendar year x Capture Factor that applies for calendar year

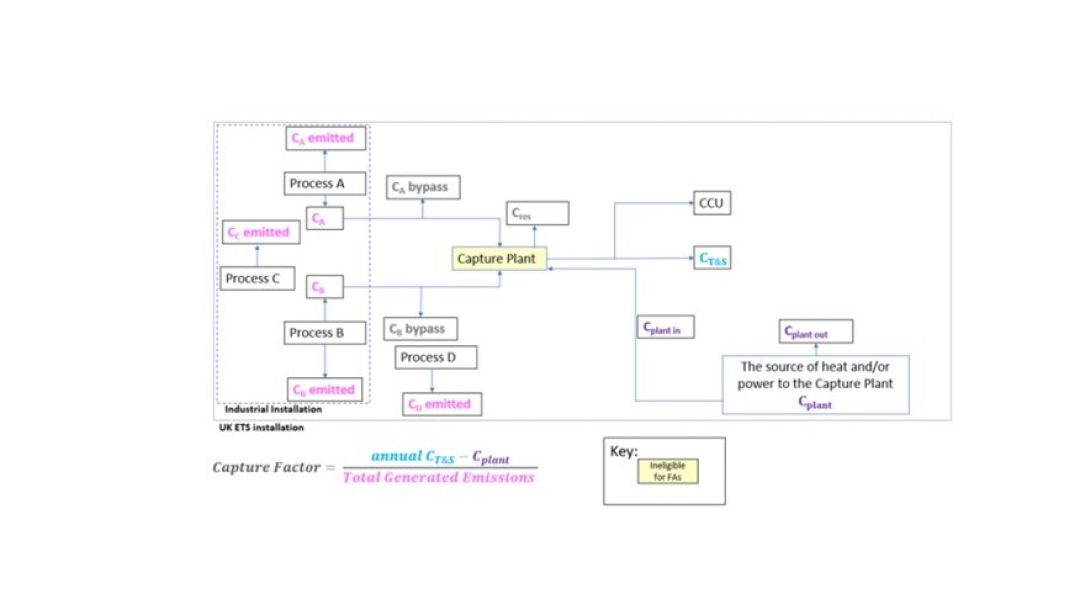

The Capture Factor represents the net percentage reduction in CO₂ emissions as a result of installing the capture plant. It will be calculated in relation to the UK ETS installation, which will comprise the industrial installation and the capture plant, calculated, for an individual based upon diagram and formula below.

Figure 2 - Schematic showing how the Capture Factor is determined for a fictitious UK ETS Installation

The money

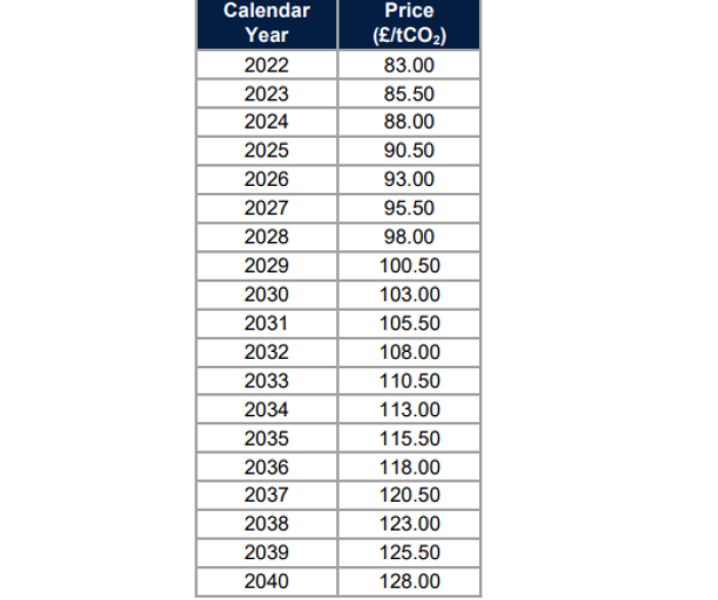

To provide certainty for the emitters building CCS facilities, the value of these allocations is based on the UK government’s fixed trajectory price, as shown below, which varies significantly from the tradable UK ETS that has in the past year diverged significantly from the EU ETS price.

Figure 3 - UK Government fixed trajectory reference price

Figure 4 - S&P Global Commodity Insights - ETS price divergence

Hence, from a financial perspective, whilst the calculations may be far more complex than the US 45Q model for support for CCS, track 1 CCS developers will be insulated against the impact of the price drop in UK ETS. The impact on other industries for that price divergence will be felt in other sectors however, as UK to EU exporters for steel and aluminium face likely border tariffs through the EU’s CBAM.

The emissions

Coming back to the reason for building a CCS industry in the UK, the primary aim to cut emissions will be supported through government incentives, and the actual agreements companies sign with the government are likely to remain confidential in comparison to the US 45Q which is open to all at $85/tonne CO2. What will be required for the industry structure, split as it is between multiple emitters feeding into a single transport and storage company within a hub environment, is regarding CO2 emissions in the same manner as other waste disposal with a clear, documented chain of custody. The two initial hubs have relatively short emitter to storage infrastructure, piped directly to offshore for sequestration. Complexity will increase further as shipping of CO2 from an industrial hub to another for sequestration purposes develops, adding further metering, energy consumption and emission sources. The CCS model puts a value directly on the emissions, and to maximise that value, the efficiency of capture needs to be in turn maximised - and all done within the determined tolerances and verified for accuracy.

Related Services